By Kate Kimmel

Fernandina Beach City commissioners voted Tuesday to reject a proposed renewal of the city’s banking services contract, citing concerns with how bids were evaluated and directing staff to seek new proposals from banks across Amelia Island rather than limiting the search to city limits.

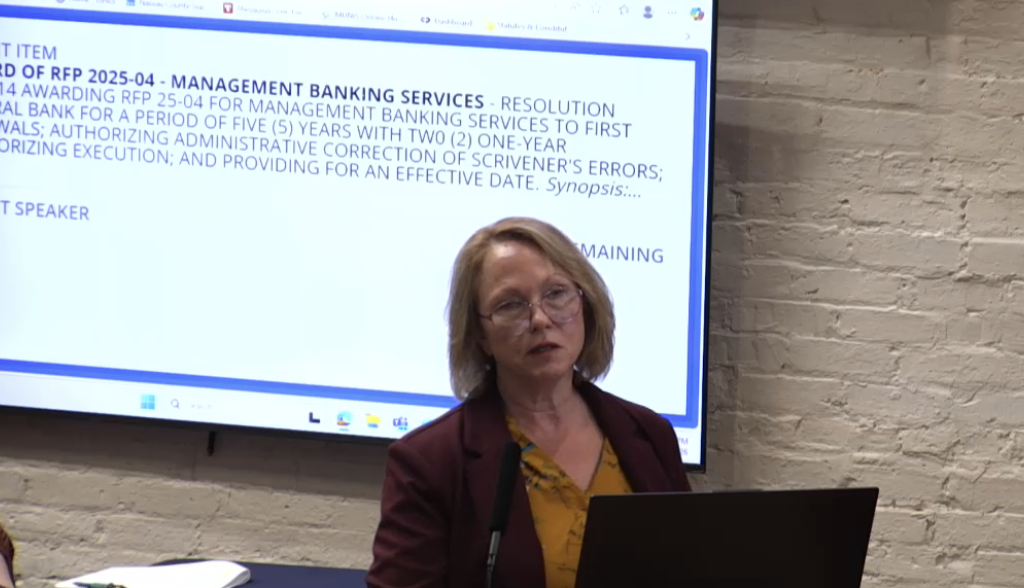

Comptroller Susan Carless presented staff’s analysis of three bids — from incumbent First Federal Bank, First Port City Bank and Regions Bank — with staff recommending First Federal as the top choice and First Port as a close second.

Commissioners, however, took issue with the request for proposals itself, particularly how interest rates were evaluated and weighted in the scoring process.

Interest rates were grouped with two other criteria, all of which were weighted together at 20%, prompting concerns that the metric did not sufficiently account for long-term financial impacts. While current rates produced nearly identical returns — 2.73% for First Federal and 2.75% for First Port — commissioners focused on how each bank’s formula would perform if federal rates declined.

First Federal’s proposal included a minimum interest rate floor of 0.25%, while First Port’s did not. Commissioner Joyce Tuten and Vice Mayor Darron Ayscue said the lack of a floor made it difficult to conduct a true “apples to apples” comparison amid market volatility.

Carless said First Port’s model could outperform First Federal’s if rates drop but would also expose the city to greater uncertainty.

Commissioners also questioned whether the scoring system favored the incumbent. Qualifications of personnel and scope of conversion were each weighted at 20%, giving those two categories a combined 40% of the total score.

Commissioner Genece Minshew argued that weighting effectively gave First Federal an advantage.

“There’s going to be some sort of home-field advantage,” Ayscue said, “but I don’t know how much of it should be weighted like it is. That’s a lot of weight for something that doesn’t seem that complicated.”

Tuten disagreed, saying conversion planning remains a legitimate consideration.

“The sitting vendor is always at an advantage with RFPs,” she said, “but understanding how another bank would convert us — the cost and time to staff — is still important. Considering interest rates as private investors is critical, but this isn’t our money.”

Carless said staff estimated that switching from First Federal to First Port would cost about $11,000 in labor, with supply costs remaining the same.

City Manager Sarah Campbell outlined commissioners’ options: award the contract to First Federal, award it to another bidder, or reject all proposals and issue a new RFP. Two motions failed — one by Tuten to award the contract to First Federal and one by Minshew to award it to First Port.

“I think at the end of the day, we’re not happy with the RFP,” Minshew said.

Commissioners ultimately voted to reject the proposals and seek new bids. Campbell said a citizen comment raised concerns that limiting the search to banks within city limits excluded other Amelia Island institutions, and commissioners agreed the scope should be expanded.

“If this is a business decision, and we have someone willing to make a more competitive bid, we should be open to that,” Mayor James Antun said.

Campbell also asked whether community involvement should be considered as part of the evaluation. Commissioners largely rejected the idea.

“I don’t think that should be considered,” Tuten said. “It’s wonderful, and we love that, but how on earth do we measure it?”

Minshew agreed, saying the decision should focus on service quality, options and financial return.

Following the vote, Jim Weaver, a representative of First Federal Bank, criticized the decision, saying the bank had effectively won the original RFP.

“I think it’s a disservice to us and First Port to have to go back to another RFP,” he said. “We’ve shown our cards, and now everyone else knows where we stand.”

Weaver also pushed back on commissioners’ request for standardized interest rate comparisons.

“No bank is going to be forced to tell you exactly how we’re going to bid,” he said. “We all use different indexes, margins and pricing structures. That’s what makes us different.”

Campbell said staff will begin drafting a new RFP reflecting commissioners’ concerns, including greater emphasis on interest rates and an expanded bidding area beyond city limits.